Introducing USUAL: A New Standard for Governance Tokens

Unlike traditional stablecoins and yield-bearing assets that limit user benefits, USUAL offers access to both yield and growth. It rewards the growth and adoption of USD0, aligning incentives with users who help expand the protocol’s ecosystem.

TLDR

MAIN CHARACTERISTICS

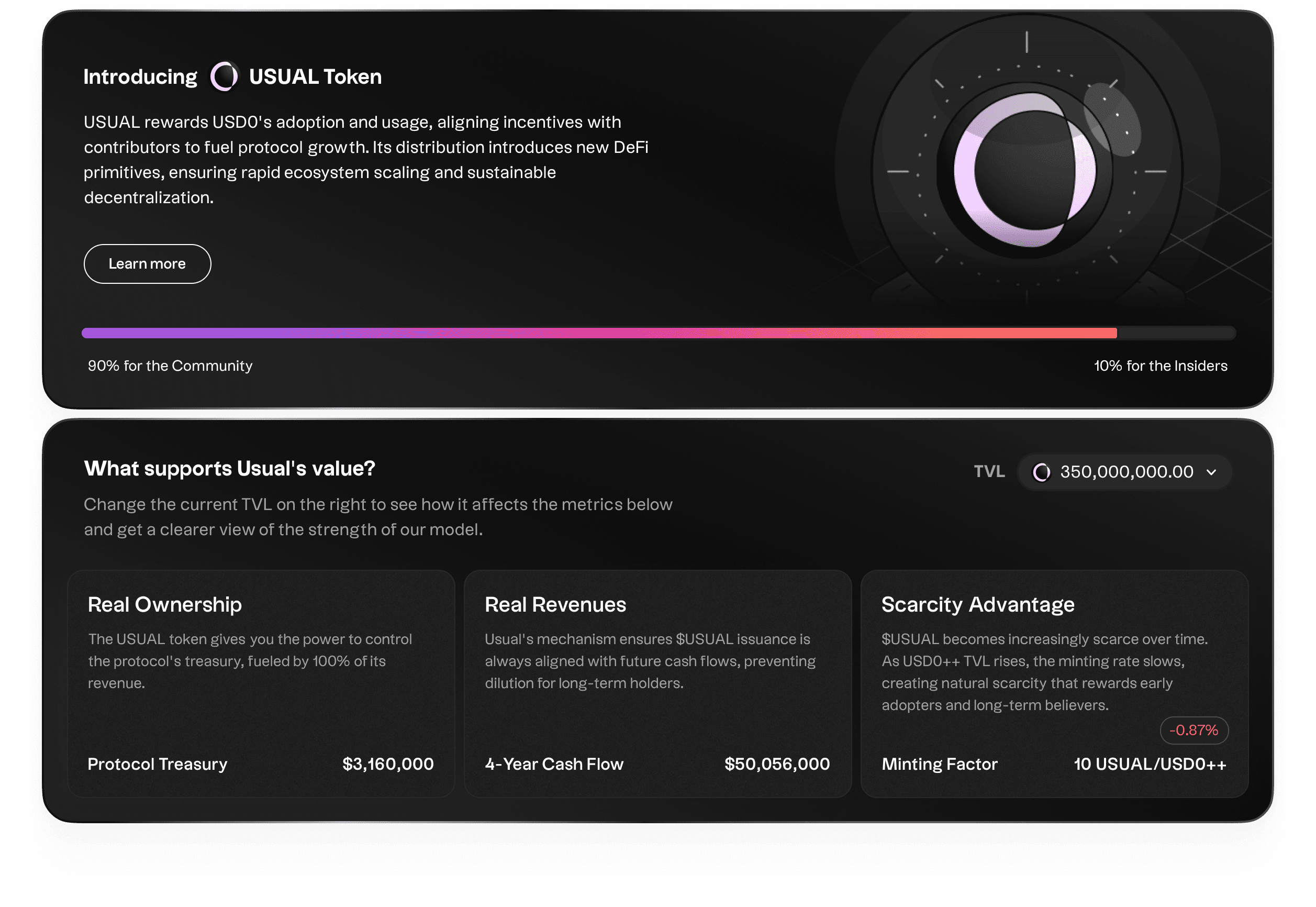

Real Ownership: USUAL represents ownership of 100% of the protocol’s revenue. It is a governance token backed by real cash flows.

Long-Term Value: USUAL is a uniquely designed long-term value token. Its issuance is carefully calibrated based on the protocol’s revenue growth, with token emissions always kept below the increase in revenue.

Scarcity with Growth: As the protocol grows, USUAL becomes increasingly scarce. The emission rate of USUAL relative to total TVL decreases with new deposits, which is intended to boost its intrinsic value over time.

Community-Focused Distribution: USUAL is a true community token. 90% of the tokens are distributed to the community, while only 10% is allocated to the insiders (team and investors).

USUAL UTILTY & FEATURES

Usual is a utility and governance token with several financial & utility key features.

Disinflationary issuance: Issuance of USUAL is tied to the TVL of staked USD0 (USD0++), creating scarcity as new TVL enters the system.

Inflation correlated to future cash flow: USUAL issuance is aligned with future cash flows. The inflation rate of USUAL supply remains lower than the growth of revenue and treasury.

Staking rewards: By staking USUAL, holders activate governance rights and receive 10% of newly issued USUAL, incentivizing long-term behavior.

Gauge mechanism: Directs and optimizes liquidity distribution within the protocol.

Governance control & Treasury management: Provides token holders with the power to manage the protocol’s treasury and influence key financial decisions.

USD0++ Unstaking: Starting from the feature’s implementation in Q1 2025, USUAL can be burned to unlock staked USD0 (USD0++) before the end of the lock-up period.

Collateral management: Governance determines the collateral types and their respective weighting behind USD0, ensuring stability and flexibility.

Treasury management: Governance and mechanics will enable USUAL holder to manage the treasury efficiently and maximize the compounding effect.

And many more uses on the roadmap…

Why $USUAL?

The Problem with Most Gov Tokens

Unoptimized Copy-Paste Models: Many tokens today are merely copy-paste replicas, struggling to find balance between short-term farmers and long-term buyers. The selling pressure is rarely offset by long-term demand or by increasing utility and features over time.

Poor Correlation Between Value and Governance: A significant issue is the weak link between the revenues generated by protocols and the governance rights tied to the token. Too many tokens are issued by protocols with the primary goal of enriching the issuers, without creating a tangible connection between the token’s value, its revenue potential, and its real utility. As a result, these tokens remain speculative, attracting short-term traders rather than long-term investors. Their price and Fully Diluted Valuation (FDV) are often propped up by fleeting narratives.

Misalignment of Interests: Founders and project contributors typically take an oversized share of the token supply, leaving those who actually generate value—users—underserved. Moreover, poor tokenomics often lead to high token inflation, which dilutes user holdings and depresses token prices.

USUAL: The Antithesis: Where Yield Meets Growth.

USUAL: the token that benefits from adoption of USD0

While traditional stablecoins like Tether exclude users from participating in both yield and growth, and yield-bearing assets provide exposure to yield but not growth, Usual offers the best of both worlds. With Usual, you gain access to both yield generation and growth potential.

USUAL rewards the growth of USD0, its adoption, and its usage within the ecosystem. The token represents the increasing adoption of USD0, aligning incentives with users who contribute to the expansion and utilization of the protocol.

USUAL takes a different approach, emphasizing a balanced, long-term strategy that seeks to align the interests of users, contributors, and investors, focusing on real utility and sustainable value growth.

Why Is USUAL Inherently Valuable?

Valuable Due to Its Financial Design

Valuable Through Its Emission Model

No VC Dominance: Usual is a No-VC coin, with 90% of USUAL tokens distributed to those who contribute value and revenue to the protocol, primarily through USD0 TVL. Insiders, such as investors, the team, and advisors, collectively hold no more than 10% of the total circulating supply, shielding users from excessive dilution.

Emission Linked to Cash Flows: The issuance of USUAL is directly correlated to future cash flows generated primarily by the stablecoin’s collateral. The token supply increases in line with protocol revenue growth, which is driven by collateral staked by USD0 holders.

Focused on Long Term ownership: Unlike many models where new entrants dilute the value and supply of governance tokens, pushing early adopters to sell quickly, Usual protects its long-term community. The model is designed to incentivize long-term holders, preserving the value for those who believe in the protocol’s future.

Decreasing Issuance Over Time

Front-Loaded Distribution: The highest distribution rate occurs during the initial airdrop, decreasing over time as staked TVL increases.

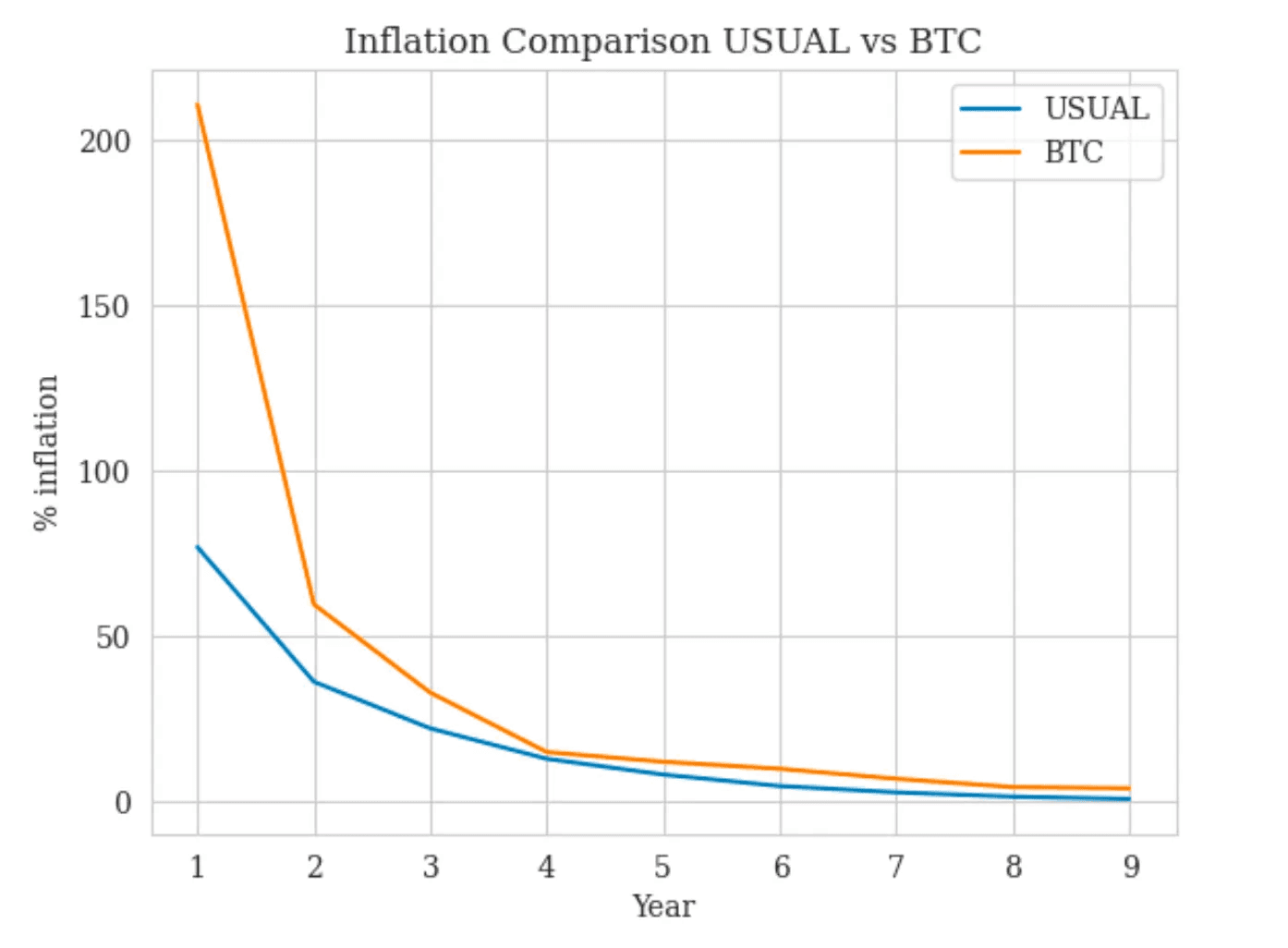

Disinflationary Issuance Model: Usual’s emission model is designed to be disinflationary, much like Bitcoin. The inflation rate is calibrated to remain below the revenue growth of the protocol, ensuring that token issuance does not outpace the protocol’s economic expansion.

Valuable Through Its Cash Flows

Direct Rights to Protocol Revenue: The USUAL governance token grants holders absolute rights over the protocol’s treasury. Unlike many governance tokens tied to non-revenue-generating protocols, USUAL’s value is directly correlated to the cash flow produced by the protocol.

Earnings Per Token Increase with TVL: The emission model ensures that as the TVL grows, the Earnings Per Token (EPT) rise, enhancing the intrinsic value of USUAL. This mechanism aligns the token’s value with the protocol’s success, incentivizing growth and long-term participation.

Valuable Due to Its Utility Features

Staking Mechanism: To activate governance rights, users must stake their USUAL tokens. Staking USUAL grants access to 10% of future USUAL emissions, incentivizing long-term participation and rewarding early believers.

Early Unstaking Option: USD0++ is a Liquid Staking Token (LST), where staked USD0 can be unlocked before the four-year period by burning a portion of USUAL tokens received as rewards. This feature will be implemented starting from Q1 2025.

Gauge Voting: USUAL holders guide protocol liquidity and influence key decisions, ensuring their active role in the protocol’s growth and success.

Treasury Management: USUAL holders will also have the ability to decide how the treasury and protocol revenues are managed, through future mechanisms such as token burns or revenue distributions (and investment allocation of the treasury).

$USUAL Tokenomics

The tokenomics of USUAL are structured around two main phases:

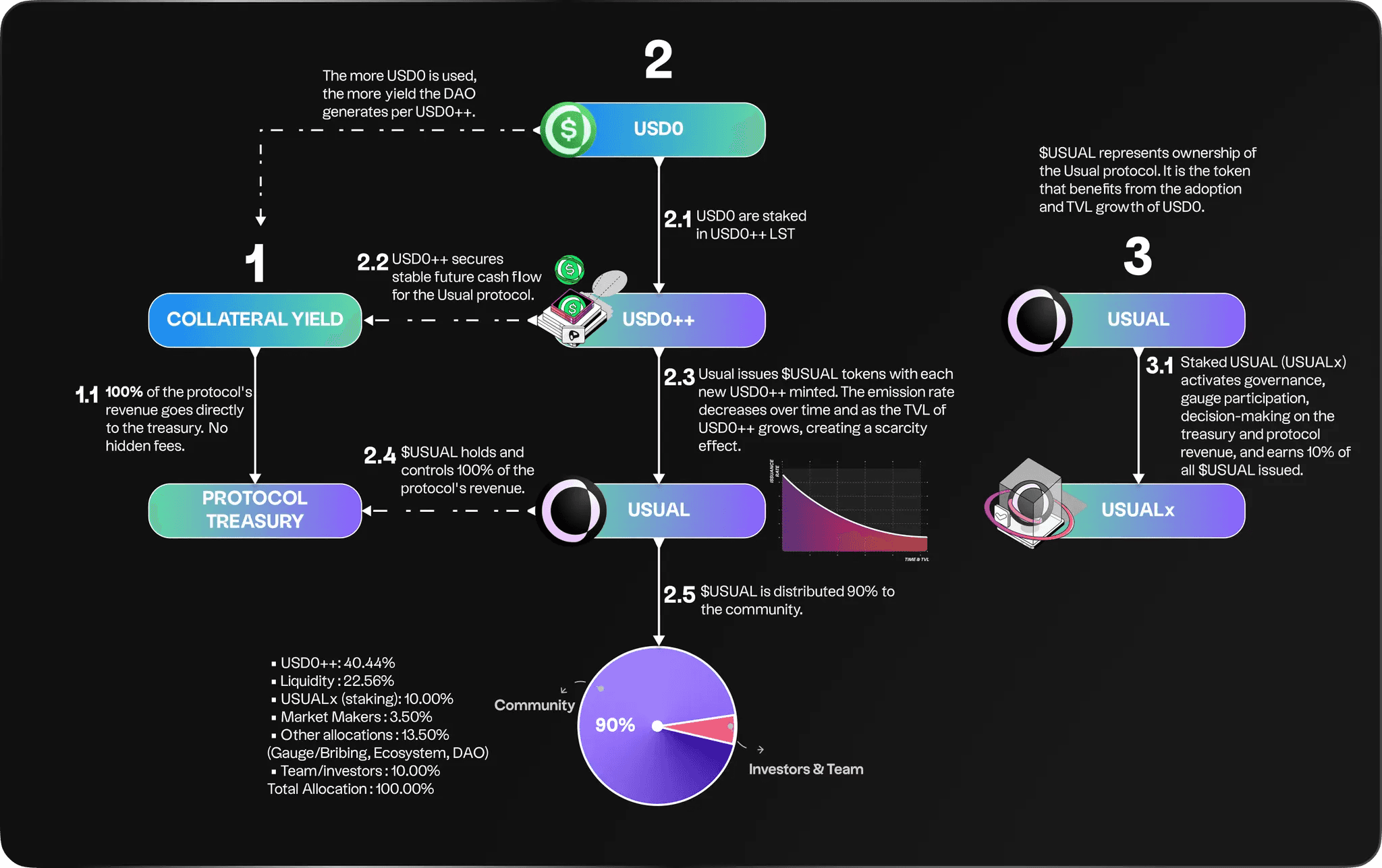

USUAL Token Issuance: USUAL tokens are issued based on the amount of USD0++ minted. Each minting event triggers the issuance of a corresponding number of USUAL tokens, reflecting the growth in protocol activity and underlying assets.

Distribution of USUAL to Value Contributors: USUAL tokens are allocated to users who contribute value to the Usual protocol. This distribution is designed to incentivize behaviors that enhance the protocol’s growth, security, and overall adoption. Value contributors may include liquidity providers, active users, and partners who bring additional Total Value Locked (TVL) to the platform.

USUAL Emission Model

Sustainable Growth and Scarcity

The emission model of $USUAL is designed to promote scarcity and align incentives for early adopters and long-term holders.

Before diving into the emission mechanics, it’s important to note that as the TVL of USD0 grows, the protocol generates more revenue. 100% of these revenues are allocated directly to the protocol’s treasury, with no hidden fees or off-chain charges.

When a user stakes their USD0 (2.1), they are essentially securing the protocol’s future revenue potential. This staking allows the protocol to issue $USUAL tokens, which are only minted against the guarantee of future revenue, ensuring that $USUAL holders are protected from dilution over time. Moreover, the emission of $USUAL is disinflationary: as the TVL of USD0++ increases, the rate of token issuance gradually decreases, further supporting scarcity (2.3). As the protocol’s TVL increases, revenue grows and the treasury accumulates more value. However, the emission rate of $USUAL decreases, reducing the number of tokens issued per locked dollar. This reduction boosts the Earnings Per Token, leading to a natural increase in the price of $USUAL.

Usual enables complete control over 100% of the protocol’s revenue through its treasury, while also offering various utilities that add extra value (2.4). The model is community-focused, with 90% of tokens distributed to the community through mechanisms such as liquidity incentives, ensuring broad participation and alignment with the protocol’s growth (2.5).

In this model, early participants benefit the most, as the decreasing issuance over time favors long-term holders and promotes a more sustainable ecosystem.

Emission Strategy: A New Approach to Tokenomics

The USUAL token uses a dynamic supply-adjusted emission mechanism that adjusts daily emissions based on:

TVL Growth, specifically USD0++ denominated TVL.

Changes in interest rates of assets backing USD0.

The objective is to influence the token supply to increase its intrinsic value over time as the token becomes scarcer. Token emissions are distributed across various channels, known as “buckets,” to align incentives within the ecosystem.

The supply of USUAL does not follow a strict emission schedule. Though more tokens are issued over time, the emission rate fluctuates, remaining significantly lower than the treasury’s growth rate. This ensures that inflation (the increase in token supply) does not lead to dilution.

Key points

Capped emissions: A maximum threshold is set to prevent excess inflation.

The emission rate decreases as the USD0++ supply grows.

Emission adjusts based on interest rates, maintaining fairness for users in both low and high-interest rate periods.

The minting rate adjusts according to TVL growth and interest rate changes and is capped to prevent excessive emissions. The minting rate can further scaled by the DAO via $USUAL governance, highlighting another important right of $USUAL holders.

USUAL Distribution

Community-Driven Distribution and Value Protection

The majority of $USUAL tokens are distributed to users who actively contribute to the protocol’s growth and value creation. The model is designed to protect the community from any dilution caused by the team or investors, ensuring that incentives remain aligned with those who drive the protocol’s success.

Detailed distribution

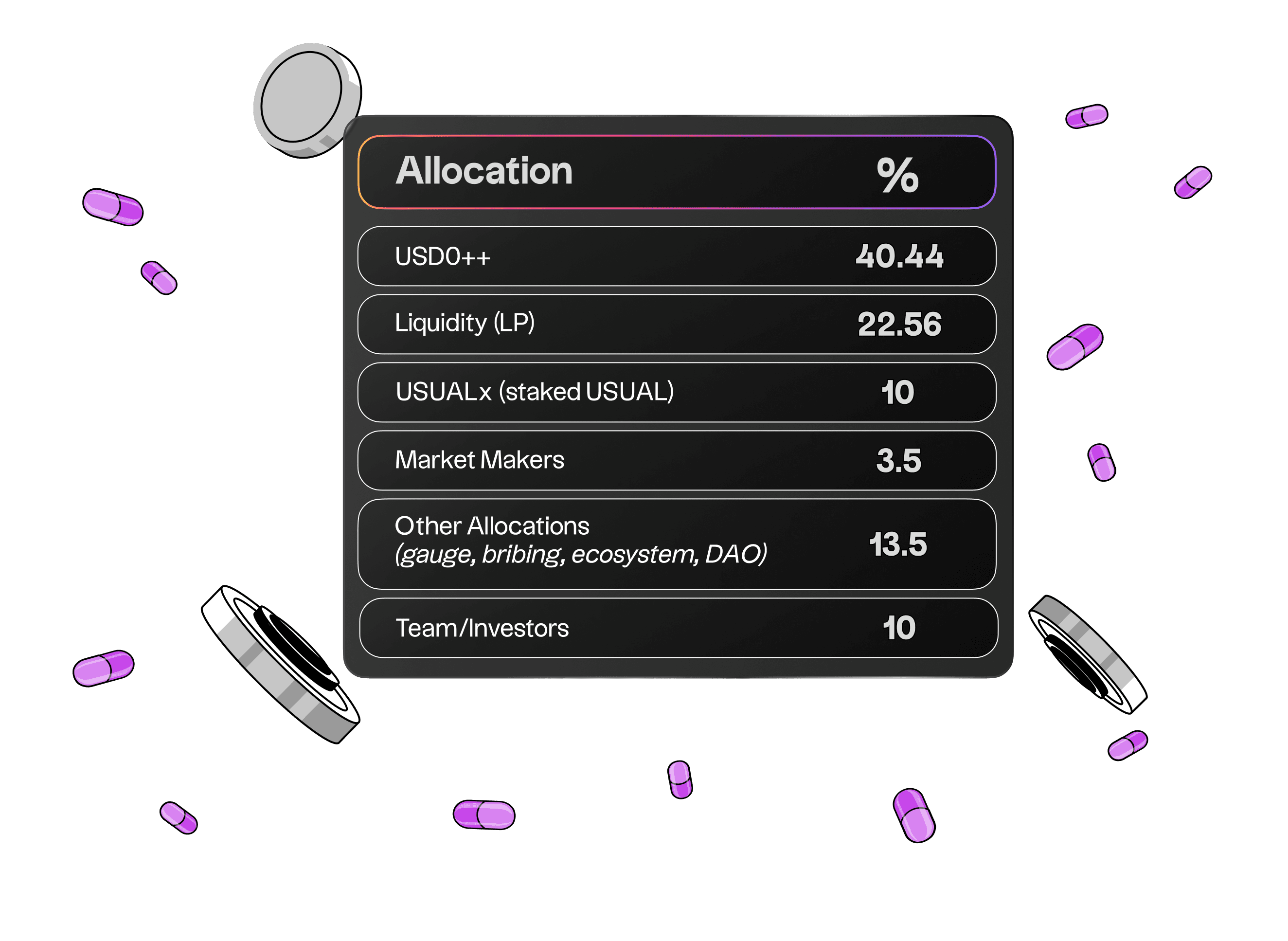

Emissions are split into various distribution allocations which can be modified by governance vote, each serving a distinct purpose:

You’ll be able to find more details in the Usual litepaper, which will be published in the coming days.

Inflation Analysis

The emission model is designed to minimize inflation. Under a conservative assumption (fixed interest rates), USUAL’s inflation rate remains lower than Bitcoin’s. The model also considers a worst-case scenario, where the token’s inflation rate is still limited due to its capped emission mechanism.

This framework outlines a balanced tokenomics model that ties USUAL’s supply growth to ecosystem expansion while mitigating inflation. The bucketed allocation structure ensures fair rewards distribution, while governance mechanisms provide flexibility for future adjustments.