Today, the most profitable entities in crypto are stablecoin issuers, functioning much like commercial banks. These organizations manage vast amounts of liquidity but fail to share the value they generate. They privatize profits while so...

The Problem (Why)

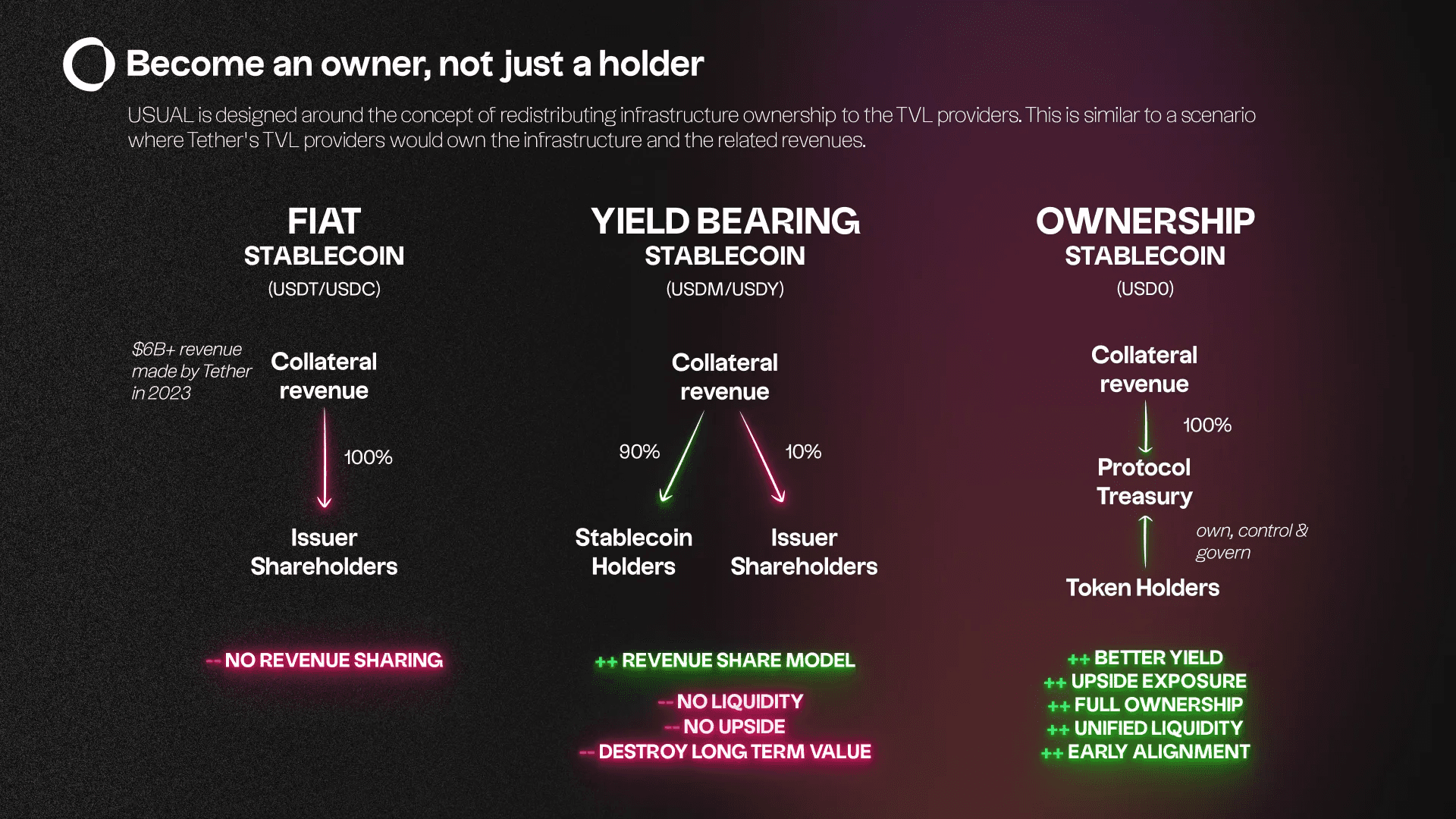

Today, the most profitable entities in crypto are stablecoin issuers, functioning much like commercial banks. These organizations manage vast amounts of liquidity but fail to share the value they generate. They privatize profits while socializing losses, benefiting insiders at the expense of users. Stablecoins have effectively become the liquid form of deposits, and in the future, every liquidity layer within a bank could be tokenized into stablecoins.

At the same time, simple revenue sharing proves insufficient, and revenue-sharing models have demonstrated their weaknesses and lack of appeal in the crypto market. Indeed, early users have no way to be exposed to the protocol's growth. It is simply a pure savings product that offers no upside potential to liquidity providers.

Simultaneously, crypto tokenomics —meant to distribute value fairly— are broken. Most tokens are disconnected from the real value generated by their underlying protocols. Instead of fostering long-term value creation, they benefit insiders, dilute users, and ultimately erode value.

As a result, users end up with tokens that lose value over time, while insiders claim the majority of the rewards. The tools designed to promote decentralized ownership and governance are repurposed for speculation, leaving behind little real utility or value for users.

While traditional stablecoins like Tether exclude users from participating in both yield and growth, and yield-bearing assets provide exposure to yield but not growth, Usual offers the best of both worlds. With Usual, you gain access to both yield generation and growth potential.

USUAL rewards the growth of USD0, its adoption, and its usage within the ecosystem. The token represents the increasing adoption of USD0, aligning incentives with users who contribute to the expansion and utilization of the protocol.

The Solution (What)

Usual has leveraged past DeFi experiences and tokenomics lessons to introduce a new layer of utility. $USUAL serves as the protocol’s equity, with no private company behind the scenes to run the protocol or collect fees. The value generated flows entirely within the ecosystem, ensuring true decentralization and community ownership.

Usual was created to change this broken system. It represents a new paradigm in banking and value distribution, where users are not merely consumers but co-owners of the protocol itself. Usual’s model ensures that the value generated by the protocol is returned to the community.

By holding and using Usual’s stablecoin, users gain ownership of the protocol. The value generated by the protocol is redistributed through tokens, allowing it to grow and compound over time. Unlike traditional models, where insiders profit the most, Usual ensures that 90% of this value is returned to the community, empowering users rather than insiders.

With Usual, the future of finance becomes transparent, community-driven, and designed to reward those who actively contribute to its growth.

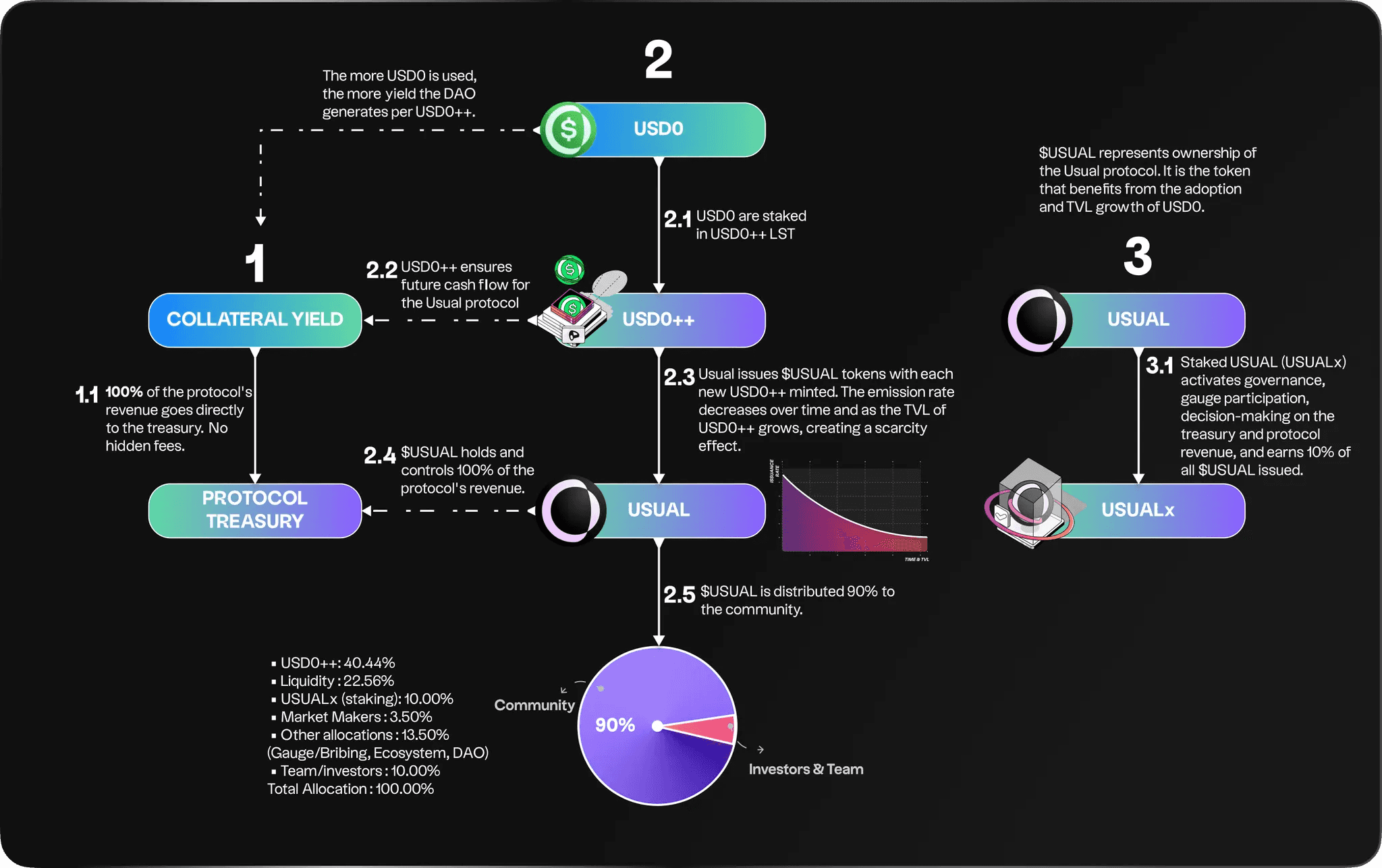

Usual’s Flow

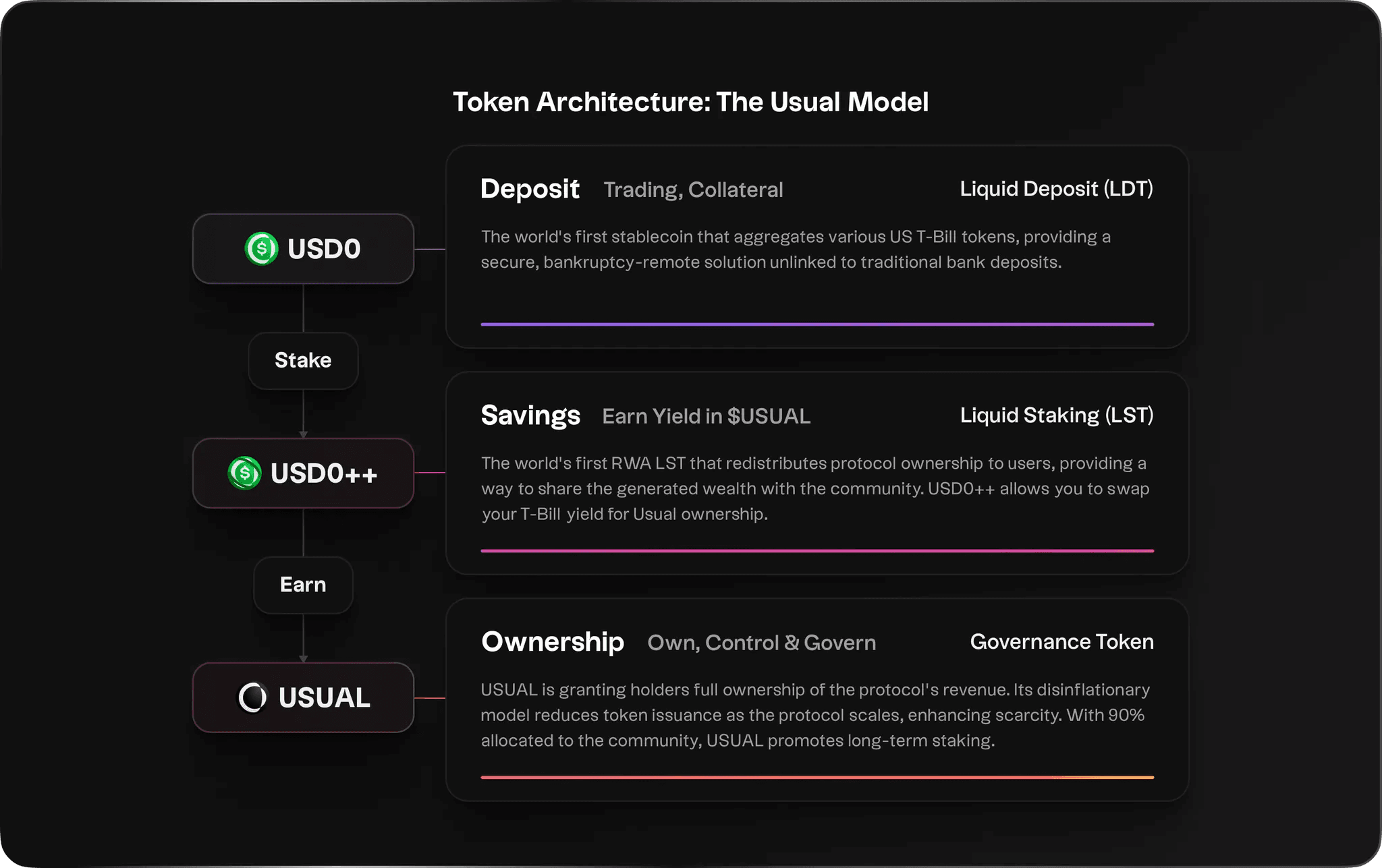

USD0 as Liquid Deposit – Usual’s liquid deposit token, serving as a payment method and future collateral on exchanges. It functions similarly to a liquid bank deposit, offering immediate accessibility and utility.

USD0++ as Liquid Staking – The staked version of USD0, acting as a Liquid Staking Token (LST) for Real World Assets (RWAs), with a 4-year lock-up period. It operates like a liquid savings account, offering rewards while keeping your position transferable.

Governance Token ($USUAL) – Represents ownership in the protocol, akin to the equity of a bank. It grants holders a stake in the protocol’s long-term success, distributing rights and benefits to align interests between users and the protocol.

Usual’s RWA Infrastructure (How)

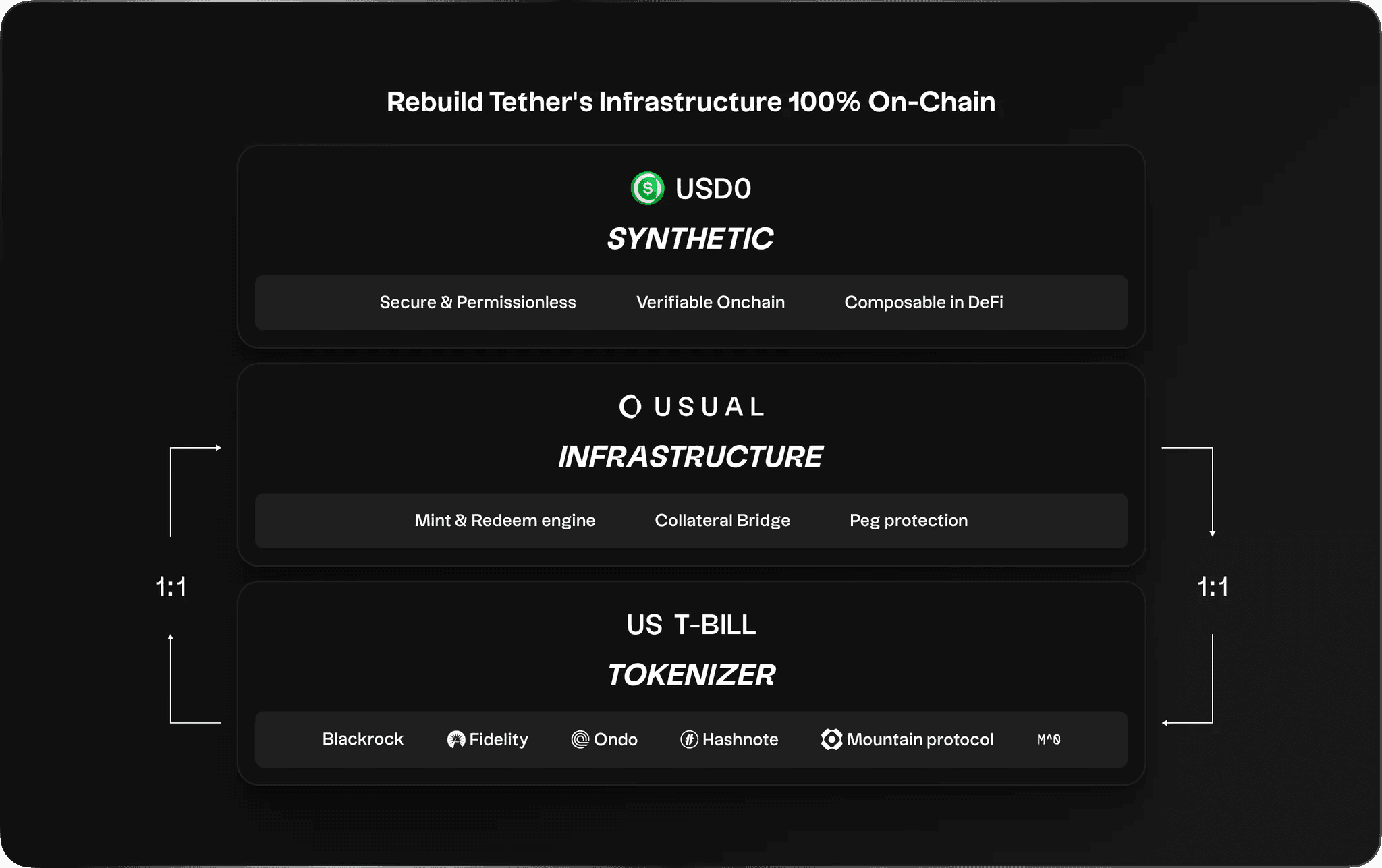

Usual is an infrastructure platform that bridges Real-World Assets (RWAs) with DeFi, offering a solution for distributing T-Bill exposure within the decentralized finance ecosystem. By issuing a permissionless stablecoin (USD0), Usual enables the indirect distribution of RWA-backed assets, such as T-Bills and revenue-sharing stablecoins, which often face scalability challenges in traditional finance.

How It Works:

Stablecoin Issuance: Usual mints USD0, a permissionless stablecoin, fully backed by collateral. This stablecoin serves as a bridge, allowing users to gain exposure to T-Bills and other tokenized RWAs.

Distribution Channel for RWA Tokenizers: Usual facilitates the integration of RWA tokenizers like T-Bill token issuers and revenue-sharing stablecoins into DeFi, making it easier for them to scale by using USD0 as the gateway.

Strategic Integrations: The platform collaborates with leading protocols such as M0, Blackrock, Ondo, Centrifuge, OpenEden, and Franklin Templeton to expand access to real-world financial instruments.

Key Features:

Innovative Mint Engine: Unlike traditional Collateralized Debt Positions (CDPs), Usual’s mint engine ensures that USD0 is always fully collateralized, providing a stablecoin that is 100% efficient.

Peg Protection: The system incorporates a robust collateral controller to maintain the peg of USD0, ensuring stability and security for users.

Usual’s Financial Infrastructure (How)

The emission model of $USUAL is designed to promote scarcity and align incentives for early adopters and long-term holders.

As the TVL of USD0 grows, the protocol generates more revenue. 100% of these revenues are allocated directly to the protocol’s treasury, with no hidden fees or off-the-books charges.

When a user stakes their USD0 (2.1), they are essentially securing the protocol’s future revenue potential. This staking allows the protocol to issue $USUAL tokens, which are only minted against the guarantee of future revenue, ensuring that $USUAL holders are protected from dilution over time. Moreover, the emission of $USUAL is deflationary: as the TVL of USD0++ increases, the rate of token issuance gradually decreases, further supporting scarcity (2.3). As the protocol’s TVL increases, revenue grows and the treasury accumulates more value. However, the emission rate of $USUAL decreases, reducing the number of tokens issued per locked dollar. This reduction boosts the Earnings Per Token, leading to a natural increase in the price of $USUAL.

Usual enables complete control over 100% of the protocol’s revenue through its treasury, while also offering various utilities that add extra value (2.4). The model is community-focused, with 90% of tokens distributed to the community through mechanisms such as liquidity incentives, ensuring broad participation and alignment with the protocol’s growth (2.5).

In this model, early participants benefit the most, as the decreasing issuance over time favors long-term holders and promotes a more sustainable ecosystem.

Usual’s Future (Next Steps)

Usual is a decentralized protocol with the vision of becoming a user-owned bank in the future. Currently, Usual is in its first phase, focused on increasing its TVL, similar to how a bank attracts deposits from its clients.

This initial phase revolves around liquidity, anchored by USD0, Usual’s stablecoin backed by Real World Assets (RWA), which functions as a Liquid Deposit Token. The system’s profitability comes from the collateral behind the stablecoin, which generates revenue. These revenues are accumulated in the protocol’s treasury and are controlled by governance token holders.

Liquidity and deposit growth are the foundation of Usual’s strategy before introducing new products and services that will truly democratize crypto, making it accessible with minimal barriers to entry.

In the second phase (Q1 2025), Usual will expand into new liquidity products, focusing on native DeFi solutions with collateral not limited to RWAs. This will offer users more aggressive strategies, especially in bullish market conditions. These products will further enhance the protocol’s profitability and increase the value of the governance token.